Growth Marketing In A Down Market

Here are a few quick notes about how we’re thinking and acting in light of the shaky macroeconomic outlook.

We’re carefully monitoring expenses.

We already run a tight ship financially speaking but we’re taking extra precautions based on the uncertainty in the broader markets. We’ve made some easy changes like temporarily paused travel budgets, lengthened our hiring timeline, and revised our revenue forecast to be a bit more conservative.

We’re watching metrics for evidence of a slowdown…and we haven’t seen anything yet.

Our aggregate client lead rate is largely unchanged – it’s been hovering between 0.6% and 0.7% for the past 18 months. June 2022 performance was actually better in aggregate than June 2021. So leads are still flowing for our clients.

Similarly our own sales and marketing metrics are largely unchanged. In fact June was our best sales month in the past year. This might change in the coming weeks, but so far so good.

Lead velocity will likely remain consistent…but deal velocity will slow.

When markets get tight budgets will get more scrutiny, deals will require more sign-off, and some opportunities will simply remain on hold for a few months. All of this means that you’ll probably have lower sales conversion rates, which means that you’ll need more leads to sustain your current growth rate / revenue.

We’re not cutting back on marketing at RevBoss, but we’re changing our expectations for ROI and timeline. Deals closing at a lower rate or simply taking longer will mean a lower ROI.

We’re not slowing down.

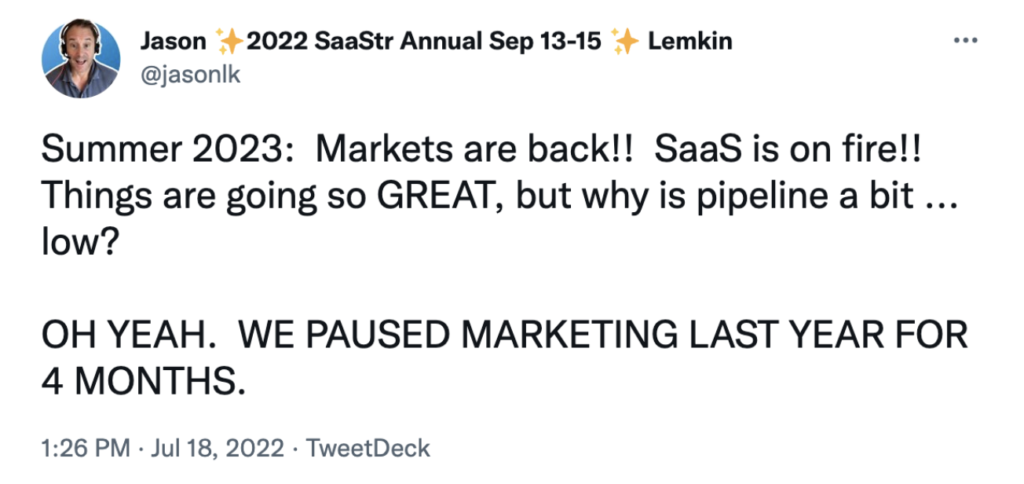

The marketing investments you make today will yield the leads and opportunities that you’re going to need in 3, 6, and 12 months from now.

In other words, ruthlessly cutting back on marketing today is like preparing for a long, hard hike and taking food out of your pack to make it lighter to carry – it’ll make things easier in the near term but can create serious problems later.

The market will find a bottom in the coming months (hopefully!), interest rates will stabilize, inflation will taper off, and we’ll back on the upswing.

We intend to plant an awful lot of seeds in the meantime.

You should too!